Self Lock Roll Forming Machine for High-Precision Roof Panels China Manufacturer

- Introduction to the Self Lock Roll Forming Machine and Market Overview

- Technical Advancements and Unique Features of Self Lock Roof Sheet Roll Forming Machines

- Comprehensive Comparison: China Self Lock Roll Forming Machine Manufacturers

- Customization Options in Self Lock Roof Panel Roll Forming Machines

- Application Scenarios and Case Studies: Real-World Usage

- Economic and Productivity Impact: ROI Analysis and Market Growth

- Conclusion: The Future of Self Lock Roll Forming Machine Technology

(self lock roll forming machine)

Introduction to the Self Lock Roll Forming Machine and Market Overview

The self lock roll forming machine

has rapidly advanced into an industry-defining technology for the formation of interlocking roof panels and sheets. As global construction projects shift towards high-strength, maintenance-free roofing systems, demand has surged for precise, automated production lines. According to recent statistics, the global market value for metal roof forming machines exceeded $3.2 billion in 2023, with self lock configurations accounting for more than 40% of new investments in the Asia-Pacific region.

In particular, countries like China, India, and Vietnam represent the most dynamic markets due to continued urbanization and infrastructure development. End-users prefer self lock systems for their superior weather resistance, quick installation, and minimal maintenance over decades. With market projections showing a CAGR of 7.8% from 2024–2028 for self lock panel equipment, understanding the key players, technological innovations, and applications of these machines is crucial for manufacturers and buyers alike.

Technical Advancements and Unique Features of Self Lock Roof Sheet Roll Forming Machines

Advancement in self lock roof sheet roll forming machine technology has transformed manufacturing processes for standing seam and interlocking metal roof panels. Modern equipment integrates advanced servo-driven feeding, fully automated PLC control systems, and hydraulic cutting to maximize both precision and efficiency.

For example, state-of-the-art machines can operate at line speeds exceeding 20 meters per minute while maintaining sheet tolerance of less than ±0.3 mm. Touchscreen HMI interfaces allow for recipe switching, parameter adjustment, and live diagnostics, boosting operator productivity by over 30%. Another notable innovation is the quick-change cassettes for forming rollers, dramatically reducing product switch-over times (often under 15 minutes).

Enhanced safety systems, including automatic emergency stop sensors and enclosure guards, further support safe, round-the-clock operations. These advancements cater to fast-paced construction timelines and minimize labor requirements, driving down production costs for project developers and EPC contractors worldwide.

Comprehensive Comparison: China Self Lock Roll Forming Machine Manufacturers

With China emerging as a dominant force in machine manufacturing, it is vital to evaluate top Chinese self lock roll forming machine brands by contrasting critical technical aspects, service levels, and export presence. The table below details a comparison of three industry-leading Chinese manufacturers.

| Manufacturer | Model Output (m/min) | Panel Width Range (mm) | Automation Level | Export Markets | After-Sales Support |

|---|---|---|---|---|---|

| Haiwei Machinery | 17–22 | 300–1000 | Fully Automated, Remote Diagnostics | 70+ Countries | Global Onsite + Online |

| Fame Best Group | 10–15 | 400–750 | Semi & Fully Automated | Europe, ME, Americas | Local Partners + Hotline |

| BoTou Xianfa | 8–12 | 350–900 | Basic Automation | APAC, Africa | Email + Video Support |

Legend: ME = Middle East; APAC = Asia-Pacific.

This comparison underlines that fully-automated, high-speed models offered by top-tier manufacturers consistently outperform in terms of international certifications, technical reliability, and comprehensive after-sales support. Factors such as panel width flexibility and automation infrastructure are crucial discriminators for both factory owners and EPC contractors globally.

Customization Options in Self Lock Roof Panel Roll Forming Machines

Diverse building profiles and project-specific requirements have driven a rising need for customization in self lock roof panel roll forming machines. Machine builders now tailor feeder systems, roll tool designs, cutting dies, and output stacking lines to meet the distinct needs of architects and contractors.

Customization options may cover:

- Panel Profile Adjustment: Machines can be configured to produce panels with different seam heights, rib spacings, and aesthetic shapes within one setup.

- Material Range: Adaptability for galvanised steel, aluminum, and pre-painted coils from 0.4mm up to 1.2mm thickness.

- Punching/Cutting Features: Integration of online punching, in-line insulation application, or notching to support auxiliary building requirements.

- Coil Handling Systems: Auto-decoilers, straighteners, and stacking robots are available for high-volume, low-labor operations.

- Smart Control Systems: Advanced HMI and IoT modules to monitor energy usage, output quality, and predictive maintenance.

Application Scenarios and Case Studies: Real-World Usage

The deployment of self lock roof panel roll forming machines has resulted in measurable project success across multiple sectors. Major application scenarios include:

- Commercial Warehouses: Large-scale distribution centers in Southeast Asia have reduced roof installation time by 42% and cut labor costs by 28%, using self lock profiles.

- Airport Terminals: In 2022, a major international airport expansion in India used self lock interlocking panels to achieve wind uplift ratings 27% higher than traditional solutions.

- Industrial Plants: A beverage manufacturing facility in Nigeria reported a 34% reduction in leak-related maintenance after switching to self lock roof sheets produced onsite.

- Sports Stadia: Chinese roll forming lines enabled rapid on-site assembly of complex curved roof modules, aiding a stadium's 6-month completion target for the Asian Games.

Such case studies confirm the global performance reliability and value proposition these machines bring to modern construction projects.

Economic and Productivity Impact: ROI Analysis and Market Growth

Investing in a self lock roll forming system can substantially improve bottom-line performance and manufacturing resilience. Through integrated automation and material optimization, owners report up to 18% reduction in raw material waste and a 22% boost in net productive capacity versus legacy profiling technology.

A typical mid-sized factory can recoup its capital investment within 10–16 months of operation. The following table illustrates a ROI analysis based on real operational data from international factories, demonstrating reduced costs and improved revenue streams.

| Metric | Traditional Roll Former | Self Lock Roll Forming Machine |

|---|---|---|

| Material Scrap Rate (%) | 4.2 | 1.8 |

| Production Output (sqm/hr) | 480 | 690 |

| Manual Labor Required | 8 workers | 4 workers |

| Time to Roof Completion (per 1000 sqm) | 2.4 days | 1.3 days |

With construction sectors adopting more sophisticated jobsite organization and just-in-time logistics, such gains provide decisive competitive advantages. Reports from the International Roofing Federation suggest market share for self lock profiles will surpass 55% of all steel roofing installations by the end of this decade.

Conclusion: The Future of Self Lock Roll Forming Machine Technology

The ongoing evolution of self lock roll forming machine technology is delivering measurable production and performance gains for manufacturers and end-users alike. As demand for robust, maintenance-free, and energy-efficient building envelopes climbs, these machines are set to play an ever-greater role in the global construction industry.

Emerging trends such as Industry 4.0 digitalization, AI-driven quality control, and eco-friendly material handling promise to further enhance capabilities. Forward-thinking manufacturers will continue to leverage advanced self lock machines to fulfill bespoke project needs, maximize ROI, and ensure long-term competitiveness.

In summary, commitment to innovation, superior technical performance, and adaptable design are the definitive factors that will shape the future of this dynamic sector, cementing the self lock roll forming machine’s position as an essential asset in modern construction workflows.

(self lock roll forming machine)

FAQS on self lock roll forming machine

Q: What is a self lock roll forming machine?

A: A self lock roll forming machine is a type of equipment designed to produce self-locking roof sheets or panels. It forms metal coils into specific profiles with interlocking edges without additional fasteners. This ensures easy installation and a weather-tight seal.Q: What materials can a self lock roof sheet roll forming machine process?

A: Self lock roof sheet roll forming machines can process various materials like galvanized steel, aluminum, and color-coated steel. The thickness usually ranges from 0.3mm to 1.2mm. Material choice depends on your project requirements.Q: How does a self lock roof panel roll forming machine work?

A: The machine feeds metal coils through successive forming rollers to shape the self-locking profile. Each set of rollers gradually bends the metal to the desired roof panel design. The finished panels are then cut to length automatically.Q: Why choose a China self lock roll forming machine?

A: China is known for its advanced manufacturing and competitive pricing on roll forming machines. Chinese suppliers offer customization, reliable quality, and worldwide support. This makes them a popular choice for buyers globally.Q: What are the main benefits of using a self lock roll forming machine?

A: It increases efficiency by automating panel production and minimizing labor costs. The self-locking design improves roof integrity and installation speed. Overall, it ensures consistent, high-quality roof panels with excellent weather resistance.-

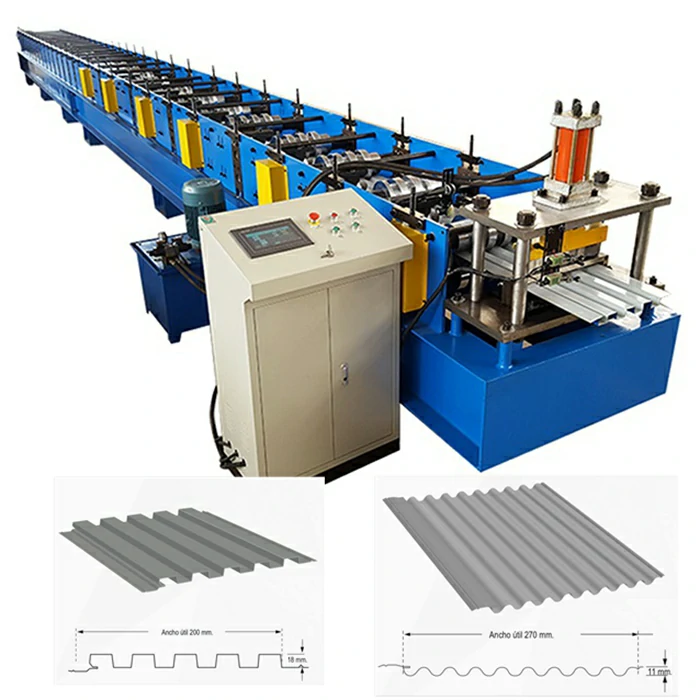

Corrugated iron roofing sheet making machine with CE, AutoNewsNov.17, 2025

-

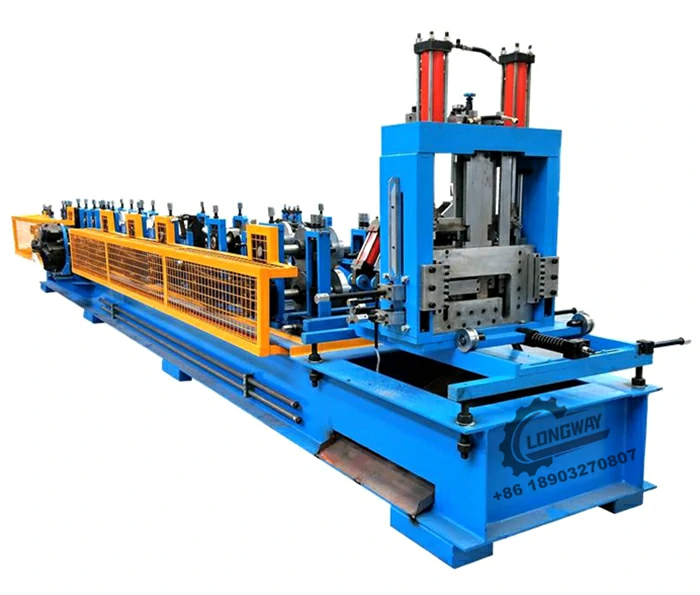

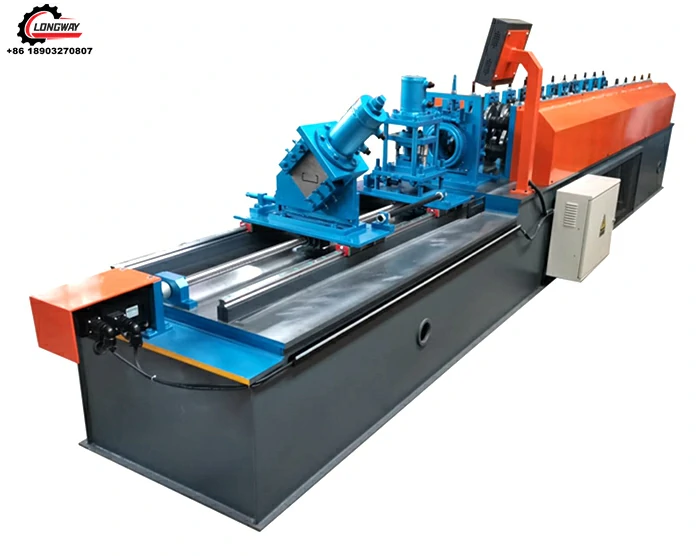

3mm Steel C U Channel Roll Forming Machine, Heavy DutyNewsNov.17, 2025

-

Calamima Micro Ondulada corrugated roof sheet machine - CNCNewsNov.17, 2025

-

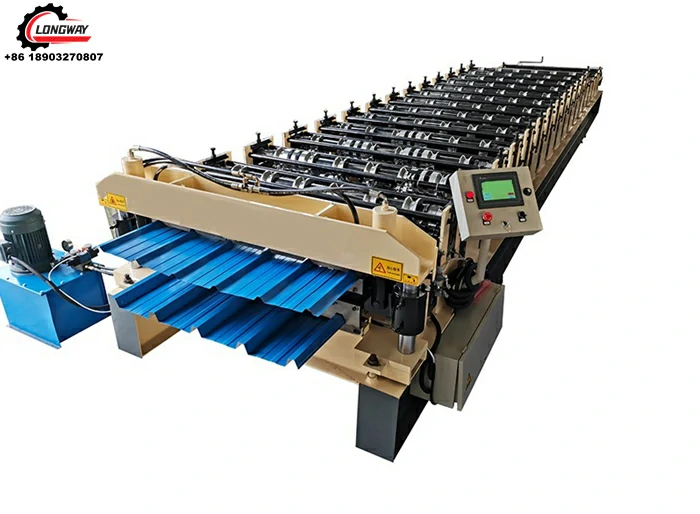

Metal Roofing Roll Former for Sale Companies - Fast, PreciseNewsNov.17, 2025

-

Drywall Steel L Angle Bar forming machine | Fast, PreciseNewsNov.17, 2025

-

Corrugated Iron Roofing Sheet Making Machine, Fast & DurableNewsNov.11, 2025

-

Corrugated Metal Roofing Machine | High-Speed, Precise, CENewsNov.11, 2025